HIGHLIGHTS

-

Assays confirm uranium mineralization across the Mineralized RIB Corridor (“MRC”) at RIB South, East and West Discoveries, where results from twelve drillholes intersected uranium mineralization (Figures 2 & 3). These results are in addition to the previously announced RIB North Discovery, where the maiden drillhole, RIBN-DD-001, returned assays with 34.7 m of total composite uranium mineralization1, including 13.6 m grading 0.53% U₃O₈, 1.1 m grading 4.81% U₃O₈, and grades up to 8.16% U₃O₈ over 0.5 m (See November 20th, 2025, RIB North Assay Release);

RIB East Discovery

-

Located on the 4.5 km long Eastern Limb of the MRC, ~1.4 km south of the significant RIB North Discovery (Figures 2 & 3);

-

Currently defined by eight diamond drillholes over a 750 m strike length that remains open in all directions, with drilling highlighted by:

-

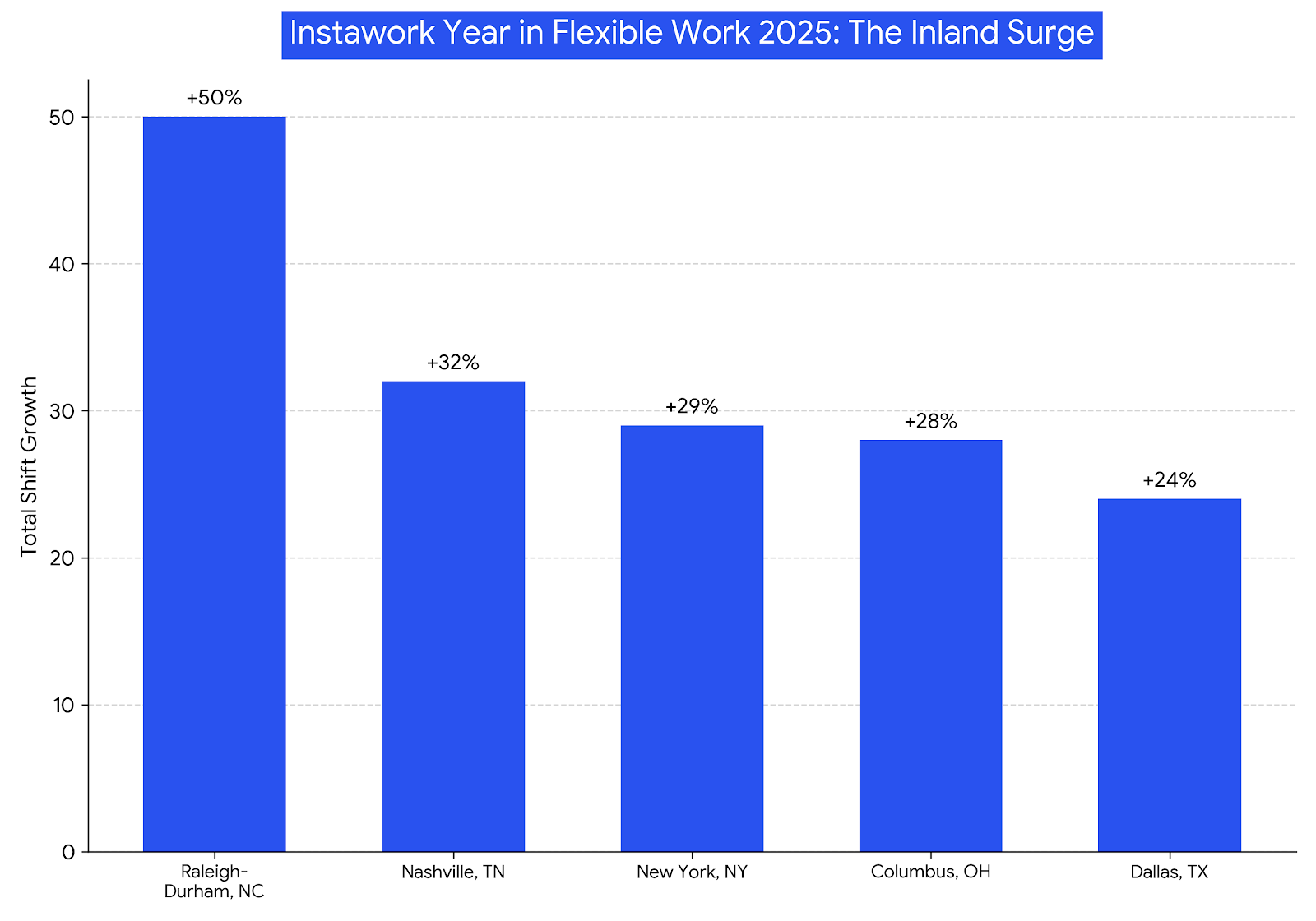

RIBE-DD-003 assays returned total composite uranium mineralization1 of 8.6 m encompassing four zones from 101.4 m to 374.1 m (Figure 4), including a high-grade intersection2 from 276.2 m to 277.3 m with 2.69% U3O8 over 1.1 m, including 5.55% U3O8 over 0.5 m;

-

RIBE-DD-007 assays returned total composite uranium mineralization1 of 8.7 m encompassing six zones from 174.0 m to 215.3 m (Figure 5), including a higher-grade intersection from 207.2 m to 211.3 m with 0.236% U3O8 over 4.1 m, including 1.15% U3O8 over 0.5 m;

-

RIB West Discovery

-

Located on the 4.0 km long Western Limb of the MRC, ~1.8 km southwest of the significant RIB North Discovery (Figures 2 & 3);

-

Currently defined by three diamond drillholes over a 2.2 km strike length that remains open in all directions, with drilling highlighted by:

-

RIBW-DD-001 assays returned total composite uranium mineralization1 of 1.7 m from 393.5 m to 395.2 m (Figure 6) with an average grade of 0.78% U3O8, including a high-grade intersection2 with 1.36% U3O8 over 0.6 m;

-

RIBW-DD-003 assays returned total composite uranium mineralization1 of 2.0 m from 234.2 m to 236.2 m (Figure 7) with an average grade of 0.291% U3O8, including a high-grade intersection2 of 1.07% U3O8 over 0.5 m;

-

RIB South Discovery

-

Located on the 4.5 km long Eastern Limb of the MRC, ~2.25 km south of the RIB East Discovery (Figures 2 & 3);

-

Currently defined by one diamond drillhole, with prospective strike length open and untested in all directions along the MRC, with drilling highlighted by:

-

RIBS-DD-001 assays returned total composite uranium mineralization1 of 2.0 m encompassing two zones from 158.5 m to 252.1 m (Figure 8), including 1.5 m from 250.6 m to 252.1 m with an average grade of 0.11% U3O8;

-

Mineralized RIB Corridor

-

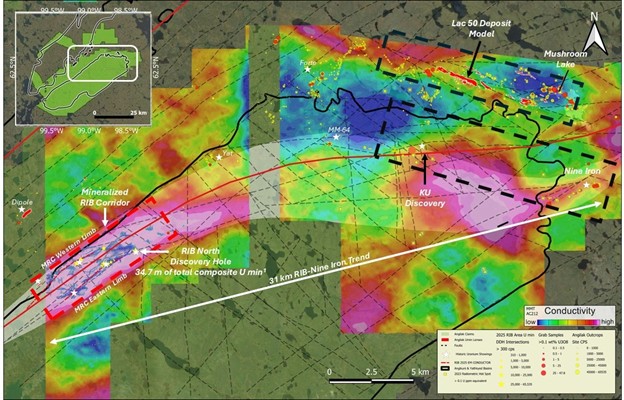

Mineralized RIB Corridor – 12 km corridor containing stacked graphitic shear zones, identified using 3D EM Inversion modeling. During the 2025 Angilak Exploration Program these EM anomalies were drill tested, resulting in a 100% success rate of intersecting uranium mineralization associated with graphitic shear zones, and the discovery of four new mineralized areas: RIB East, West, North and South, in addition to the historic RIB Discovery3 (Figures 2 & 3);

-

Uranium mineralization discovered along the MRC consists of Athabasca styles of mineralization including basement, sandstone, and unconformity hosted mineralization;

-

The MRC remains open within all discovery areas and is currently constrained only by a lack of additional MMT survey data south of the Historic RIB Discovery. Additional MMT surveys paired with 3D EM Inversion modeling is planned for 2026, designed to unlock and define the true scale and significance of the MRC and the entirety of the Angikuni Basin;

-

Additional drill core samples from the KU Discovery, Mushroom Lake, and the Lac 50 Deposit area have been submitted to the Saskatchewan Research Council (SRC) Geoanalytical Laboratory for analysis. The Company anticipates disclosing all remaining assay results in the coming weeks.

Troy Boisjoli, CEO commented: “Since acquiring the Angilak Uranium Project in 2024 ATHA has completed two successful drill campaigns comprising 46 holes across the Lac 50 Deposit and RIB-Nine Iron trends – 45 of those holes have intersected uranium mineralization. The 2024 Angilak Exploration Program focused on the Lac 50 Deposit Trend, testing the envelop of mineralization with large step outs, culminating in release of an Exploration Target for the Lac 50 Deposit area – which remains completely open and unconstrained.

During the 2025 Program, our goal was to start to unlock the regional potential of Angilak. Testing new targets which had been derisked through our systematic exploration approach, utilizing all the tools at our disposal to drill test in the most cost-effective means possible. The assay results from the Mineralized RIB Corridor, hitting uranium mineralization on 100% of the holes drilled along the 12-km MRC speaks for itself. The success we’ve had at RIB demonstrates to us that the scale of the MRC is something truly special, and may represent one of the most significant emerging uranium regions in Canada.”

Cliff Revering, VP Exploration added: “The Mineralized RIB Corridor continues to deliver compelling results, supported by the latest confirmation assays from the 2025 exploration program. Uranium mineralization encountered to date, spanning a 12 km structural corridor and anchored by the RIB North Discovery, demonstrates both scale and high-grade potential. Combined with the positive geological and geochemical signatures emerging from our 2025 work, the data increasingly points to a large mineralizing system.

Since acquiring the Angilak Project in 2024, ATHA’s disciplined exploration strategy has consistently advanced discovery within the Angikuni Basin, leveraging targeted exploration tools that enhance efficiency and reduce risk of discovery. The delineation of the Mineralized RIB Corridor within the larger RIB-Nine Iron regional trend represents a significant new development and highlights just one of several high-upside targets across the basin.

As we look ahead to 2026, ATHA is well-positioned to build on this momentum. Our objective remains clear: to continue unlocking the value of this emerging uranium district and to demonstrate the long-term growth potential of the Angikuni Basin.”

VANCOUVER, BC / ACCESS Newswire / December 10, 2025 / ATHA Energy Corp. (TSX.V:SASK)(FRA:X5U)(OTCQB:SASKF) (“ATHA” or the “Company“), is pleased to announce assay results from the remaining twelve holes drilled along the Mineralized RIB Corridor (“MRC”), completed as part of the 2025 Angilak Exploration Program at its 100%-owned Angilak Uranium Project in Nunavut, Canada (Figure 1). Assay results confirm uranium mineralization was intersected in all drillholes along the 12 km MRC, including the RIB East, West, and South Discoveries, in addition to the previously announced RIB North Discovery.

At the RIB East Discovery, a total of eight diamond drillholes were completed across a total strike length of 750 m and the area remains open in all directions. Drilling at RIB East is highlighted by RIBE-DD-003, assays returned total composite uranium mineralization1 of 8.6 m encompassing four zones from 101.4 m to 374.1 m (Figure 4). This includes a high-grade2 intersection from 276.2 m to 277.3 m with results returning an average grade of 2.69% U3O8 over 1.1 m, including 5.55% U3O8 over 0.5 m. At the RIB West Discovery, a total of three diamond drillholes were completed across a 2.2 km strike length, with the area remains open in all directions. Drilling at RIB West is highlighted by RIBW-DD-001 which returned total composite uranium mineralization1 of 1.7 m from 393.5 m to 395.2 m (Figure 6) with an average grade of 0.78% U3O8, including a high-grade2 intersection of 1.36% U3O8 over 0.6 m. RIB South is currently defined by one diamond drillhole, located ~ 2.25 km to the south of the RIB East Discovery. RIBS-DD-001 intersected total composite uranium mineralization1 of 2.0 m encompassing two zones from 158.5 m to 252.1 m (Figure 8), including 1.5 m from 250.6 m to 252.1 m with an average grade of 0.11% U3O8.

The Mineralized RIB Corridor is a 12 km long corridor containing stacked graphitic shear zones, identified using 3D EM Inversion modeling. During the 2025 Angilak Exploration Program these EM anomalies were drill tested, resulting in a 100% success rate of intersecting uranium mineralization associated with the graphitic shear zones, and the discovery of four new mineralized areas: RIB East, West, North and South, in addition to the historic RIB Discovery3 (Figures 2 & 3). Uranium mineralization discovered along the MRC consists of Athabasca style mineralization including basement, sandstone, and unconformity hosted. The MRC remains open in all directions within the discovery areas with additional prospective strike length constrained only by a lack of additional MMT survey data south of the Historic RIB Discovery. Additional MMT surveys paired with 3D EM Inversion modeling is planned for 2026, designed to unlock and define the true scale and significance of the MRC and the entirety of the Angikuni Basin.

Detailed lithologic striplogs, including assay results tables, for all twelve holes can viewed in the Supplementary Release on ATHA Energy’s website (Striplog Data).

Figure 1: Angilak Project Area – 2025 Exploration Target Area (Black Rectangles), Mineralized RIB Corridor (Red Rectangle), & Mapped Historic Mineralized Showings

Figure 2: 2025 Angilak Exploration Program – EM Inversion Model & Drill Collar Locations from MRC, along the RIB-Nine Iron Trend.

Figure 3: 2025 Angilak Exploration Program – Isometric schematic of the MRC, displaying EM Inversion model and 2025 drilling.

Table 1: 2025 Angilak Exploration Program Drill Collar Information

|

Hole ID |

Trend |

Zone |

Azimuth (°) |

Dip (°) |

Easting (mE) |

Northing (mN) |

Elevation (m) |

Final Depth (m) |

|

*KU-DD-001 |

RIB-Nine Iron |

KU Target |

30 |

70 |

515830 |

6936190 |

256.5 |

599 |

|

*J4R-DD-091 |

Lac 50 |

J4/Ray |

25 |

57 |

522295 |

6938558 |

218 |

650 |

|

*RIBE-DD-001 |

RIB-Nine Iron |

RIB East |

145 |

-55 |

497928 |

6929449 |

270 |

443 |

|

*RIBE-DD-002 |

RIB-Nine Iron |

RIB East |

145 |

-55 |

497766 |

6929322 |

271 |

345 |

|

*RIBE-DD-003 |

RIB-Nine Iron |

RIB East |

145 |

-63 |

497524 |

6929337 |

271 |

398 |

|

*RIBE-DD-004 |

RIB-Nine Iron |

RIB East |

145 |

-60 |

497404 |

6920180 |

271 |

428 |

|

*RIBE-DD-005 |

RIB-Nine Iron |

RIB East |

155 |

-65 |

497530 |

6929401 |

270 |

472 |

|

*RIBE-DD-006 |

RIB-Nine Iron |

RIB East |

145 |

-60 |

497670 |

6929501 |

273 |

491 |

|

*RIBE-DD-007 |

RIB-Nine Iron |

RIB East |

325 |

-50 |

497798 |

6929101 |

274 |

467 |

|

*RIBE-DD-008 |

RIB-Nine Iron |

RIB East |

325 |

-55 |

498284 |

6929287 |

264 |

464 |

|

*RIBW-DD-001 |

RIB-Nine Iron |

RIB West |

150 |

-50 |

495831 |

6929490 |

274 |

503 |

|

*RIBW-DD-002 |

RIB-Nine Iron |

RIB West |

145 |

-55 |

497766 |

6929322 |

271 |

380 |

|

*RIBW-DD-003 |

RIB-Nine Iron |

RIB West |

325 |

-55 |

497645 |

6930031 |

275 |

347 |

|

*RIBN-DD-001 |

RIB-Nine Iron |

RIB North |

300 |

-65 |

499574 |

6929887 |

261 |

623 |

|

*RIBS-DD-001 |

RIB-Nine Iron |

RIB South |

150 |

-50 |

495747 |

6927640 |

277.5 |

377 |

|

*KU-DD-002 |

RIB-Nine Iron |

KU Target |

30 |

-70 |

515525 |

6936210 |

251 |

616 |

|

*KU-DD-003 |

RIB-Nine Iron |

KU Target |

30 |

-70 |

515758 |

6936059 |

268.5 |

56 |

|

*KU-DD-003A |

RIB-Nine Iron |

KU Target |

30 |

-68 |

515758 |

6936059 |

268.5 |

605 |

|

*KU-DD-004 |

RIB-Nine Iron |

KU Target |

30 |

-60 |

515757 |

695641 |

255 |

602 |

|

*KU-DD-005 |

RIB-Nine Iron |

KU Target |

210 |

-70 |

515980 |

6935734 |

256 |

302 |

|

*KU-DD-006 |

RIB-Nine Iron |

KU Target |

30 |

-70 |

514794 |

6935805 |

275 |

647 |

|

*ML-DD-013 |

Lac 50 |

ML Target |

25 |

-50 |

523968 |

6939404 |

215 |

551 |

|

*ML-DD-014 |

Lac 50 |

ML Target |

25 |

-50 |

524869 |

6939109 |

206 |

407 |

*Previously released drillholes from 2025 Angilak Exploration Program

Figure 4: Striplog RIBE-DD-003 showing mineralized interval with composite uranium mineralization1 with average grades – derived from assay samples.

Figure 5: Striplog RIBE-DD-007 showing mineralized interval with composite uranium mineralization1 with average grades – derived from assay samples.

Figure 6: Striplog RIBW-DD-001 showing mineralized interval with composite uranium mineralization1 with average grades – derived from assay samples.

Figure 7: Striplog RIBW-DD-003 showing mineralized interval with composite uranium mineralization1 with average grades – derived from assay samples.

Figure 8: Striplog RIBS-DD-001 showing mineralized interval with composite uranium mineralization1 with average grades – derived from assay samples.

Assay Samples

1.Composite mineralization is calculated using a 0.01% U3O8 cutoff with a maximum internal dilution of 1.5 m.

2The Company considers high-grade mineralization to be any interval over 1% U3O8.

All drill intercepts are core width and true thickness is yet to be determined.

Core samples are submitted to the Saskatchewan Research Council (SRC) Geoanalytical Laboratories in Saskatoon. The SRC facility is ISO/IEC 17025:2005 accredited by the Standards Council of Canada (scope of accreditation #537). The samples are analyzed for a multi-element suite using partial and total digestion inductively coupled plasma methods, for boron by Na2O2 fusion, and for uranium by fluorimetry.

References for Historic Diamond Drilling Results and Surficial Sampling

3For additional information regarding ATHA’s Angilak Project please refer to the Technical Report entitled “Technical Report on the Angilak Property, Nunavut, Canada” with an effective date of October 14, 2025, prepared by Matt Batty, MSc, P. Geo, who is a “qualified person” under NI 43-101, available under ATHA’s SEDAR+ profile at www.sedarplus.ca.

Qualified Person

The scientific and technical information contained in this news release have been reviewed and approved by Cliff Revering, P.Eng., Vice President, Exploration of ATHA, who is a “qualified person” as defined under National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

About ATHA

ATHA is a Canadian mineral company engaged in the acquisition, exploration, and development of uranium assets in the pursuit of a clean energy future. With a strategically balanced portfolio including three 100%-owned post discovery uranium projects (the Angilak Project located in Nunavut, and CMB Discoveries in Labrador, and the newly discovered basement hosted GMZ high-grade uranium discovery located in the Athabasca Basin). In addition, the Company holds the largest cumulative prospective exploration land package (>7 million acres) in two of the world’s most prominent basins for uranium discoveries – ATHA is well positioned to drive value. ATHA also holds a 10% carried interest in key Athabasca Basin exploration projects operated by NexGen Energy Ltd. and IsoEnergy Ltd. For more information visit www.athaenergy.com.

On Behalf of the Board of Directors

Troy Boisjoli, CEO, ATHA Energy Corp

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

For more information, please contact:

Troy Boisjoli

Chief Executive Officer

Email: info@athaenergy.com

Website: www.athaenergy.com

Phone: 1-(236)-521-0526

Cautionary Statement Regarding Forward-Looking Information

This press release contains “forward-looking information” within the meaning of applicable Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved”. These forward-looking statements or information may relate to ATHA’s proposed exploration program, including statements with respect to the expected benefits of ATHA’s proposed exploration program, any results that may be derived from ATHA’s proposed exploration program, the timing, scope, nature, breadth and other information related to ATHA’s proposed exploration program, any results that may be derived from the diversification of ATHA’s portfolio, the prospects of ATHA’s projects, including mineral resources estimates and mineralization of each project, the prospects of ATHA’s business plans and any expectations with respect to defining mineral resources or mineral reserves on any of ATHA’s projects, and any expectation with respect to any permitting, development or other work that may be required to bring any of the projects into development or production.

Forward-looking statements are necessarily based upon a number of assumptions that, while considered reasonable by management at the time, are inherently subject to business, market and economic risks, uncertainties and contingencies that may cause actual results, performance or achievements to be materially different from those expressed or implied by forward-looking statements. Such assumptions include, but are not limited to, assumptions that the anticipated benefits of ATHA’s proposed exploration program will be realized, that no additional permit or licenses will be required in connection with ATHA’s exploration programs, the ability of ATHA to complete its exploration activities as currently expected and on the current anticipated timelines, including ATHA’s proposed exploration program, that ATHA will be able to execute on its current plans, that ATHA’s proposed explorations will yield results as expected, and that general business and economic conditions will not change in a material adverse manner. Although ATHA has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information.

Such statements represent the current view of ATHA with respect to future events and are necessarily based upon a number of assumptions and estimates that, while considered reasonable by ATHA, are inherently subject to significant business, economic, competitive, political and social risks, contingencies and uncertainties. Risks and uncertainties include, but are not limited to the following: inability of ATHA to realize the benefits anticipated from the exploration and drilling targets described herein or elsewhere; in ability of ATHA to complete current exploration plans as presently anticipated or at all; inability for ATHA to economically realize on the benefits, if any, derived from the exploration program; failure to complete business plans as it currently anticipated; overdiversification of ATHA’s portfolio; failure to realize on benefits, if any, of a diversified portfolio; unanticipated changes in market price for ATHA shares; changes to ATHA’s current and future business and exploration plans and the strategic alternatives available thereto; growth prospects and outlook of the business of ATHA; and the ability to advance the Company projects and its proposed exploration program; risks inherent in mineral exploration including risks related worker safety, weather and other natural occurrences, accidents, availability of personnel and equipment, and other factors; aboriginal title; failure to obtain regulatory and permitting approvals; no known mineral resources/reserves; reliance on key management and other personnel; competition; changes in laws and regulations; uninsurable risks; delays in governmental and other approvals, community relations; stock market conditions generally; demand, supply and pricing for uranium; and general economic and political conditions in Canada, Australia and other jurisdictions where ATHA conducts business. Other factors which could materially affect such forward-looking information are described in the filings of ATHA with the Canadian securities regulators which are available on ATHA’s profile on SEDAR+ at www.sedarplus.ca. ATHA does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

SOURCE: ATHA Energy Corp

View the original press release on ACCESS Newswire